Monthly Savings Plan / Lump Sum Investments

Grow your investments over the long term

Making regular monthly contributions to your investments as part of a savings plan can help them grow into a sizeable sum over the long term, even if you’re only investing a small amount.

Investing smaller sums on a regular basis might also mean you can start investing sooner, giving you time to take advantage of the growth potential of compounding and the markets themselves. You may be surprised at how much even small amounts can grow to over a number of years.

Alternatively, depending on your personal circumstances, it may make sense to make a lump sum investment. Simply speak to one of our consultants and we can explain everything to you.

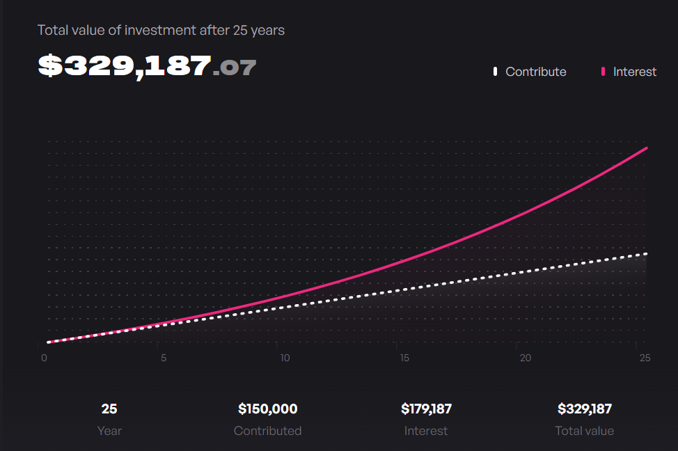

Monthly Savings Plan

This example shows how investing $500 each month and reinvesting the dividends has affected returns over 25 years with an average interest rate of 6% p.a.

This is known as ‘Compounding’ and can have a dramatic effect on returns.

Portfolio Management Services

Your partner, every step of the way

With our portfolio management service, our investment managers build and run a portfolio on your behalf

Our portfolio management services

We believe it is more important to manage your portfolio to meet your risk objectives rather than to chase short-term returns, so we will design your portfolio to meet your needs and attitude to risk.

Our investment management team will look for suitable opportunities from around the world, investing in individual stocks and bonds, and other alternative asset classes, providing access to a wide range of investment styles and strategies.

Clients benefit from our Global research capabilities

With over 25 years working with Asian clients, Fidelis has a successful track record helping clients protect and grow their wealth.

All of the portfolios are well diversified by both geography and asset class, offering what we believe is the optimal mix of equity, fixed income, and alternative type funds to achieve the best risk-adjusted returns.

Investing across a range of assets gives you exposure to a wider set of opportunities while also reducing risk.

Selecting the right funds is a complex process and the research team has developed an advanced research based systematic approach for fund selection.

Managing your portfolio

Your portfolio will require active management to ensure the strategy responds to changing conditions in the global economy and financial markets. You may decide to make all changes to the portfolio yourself or alternatively our investment manager can be responsibly for making any adjustments to the portfolio, as well as managing your expectations of what we can achieve. It is your choice.

We take a realistic approach to managing portfolios. Recent history reminds us that the unpredictable happens more frequently than expected, so we position portfolios to protect your wealth over the medium to long term.

Internal and external research

We achieve results by harnessing our extensive international connections and resources. Our investment process captures the best thinking of our strategists, analysts and investment managers, which we use to build and manage your portfolio.

We blend our in-house investment expertise with outside specialists to ensure you benefit from the best investment thinking.

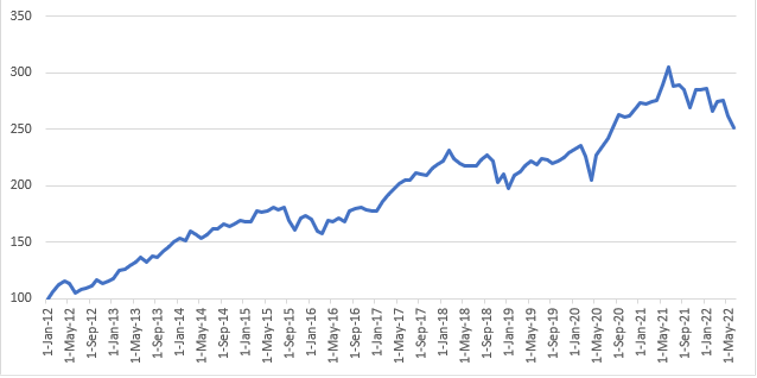

Da Vinci Asset Management Portfolio

Da Vinci Asset Management’s regular savings portfolio has achieved a yield of 150.84% since 2012 with an annualized return of 9.15%

Da Vinci Asset Management is the parent company of Fidelis and has been the portfolio manager since 2003. The same management team is now working directly for Fidelis and will be managing the portfolios as before.

Our portfolio selection process

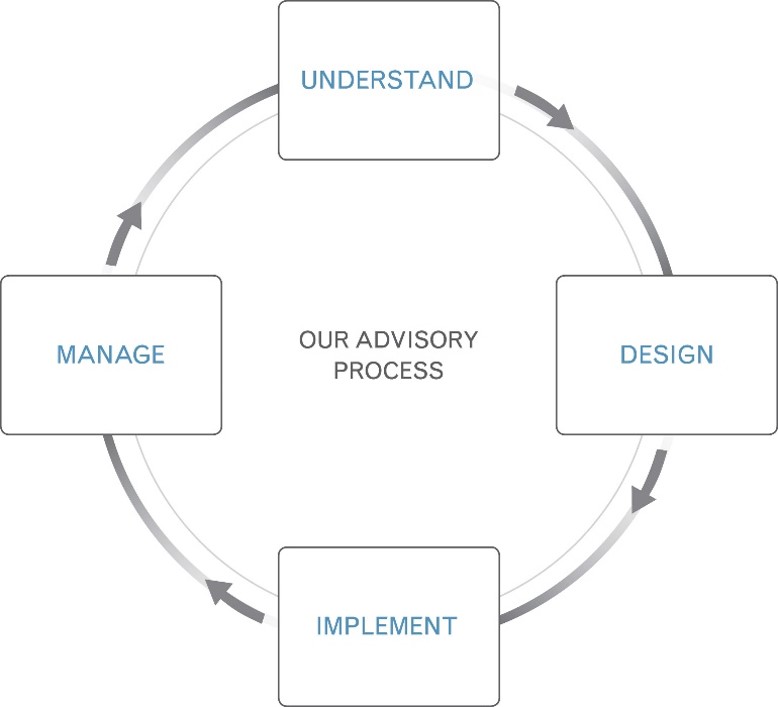

The process starts with understanding our clients’ needs.

Portfolios are constructed around your needs

- Managed by our dedicated investment team

- Our collective investment expertise is working on your behalf

- Access to a wide range of asset classes and markets

- 24/7 account access

- Regular newsletters and expert analysis

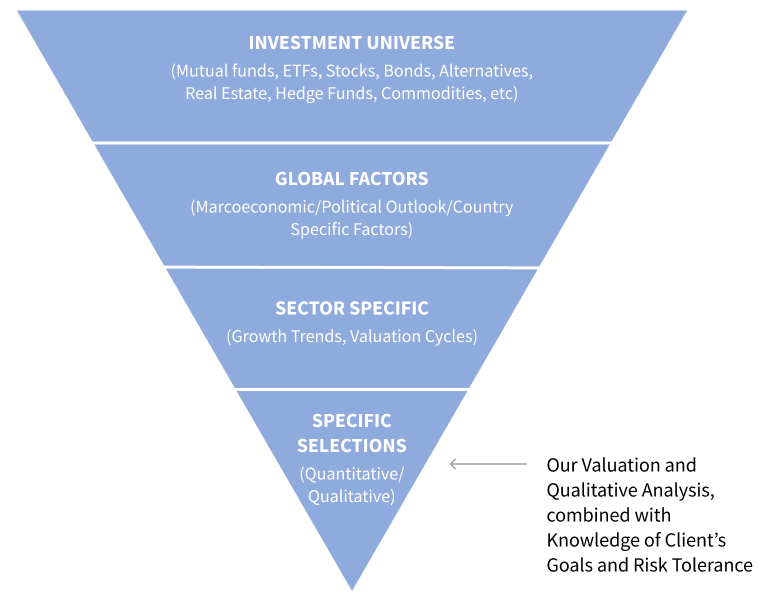

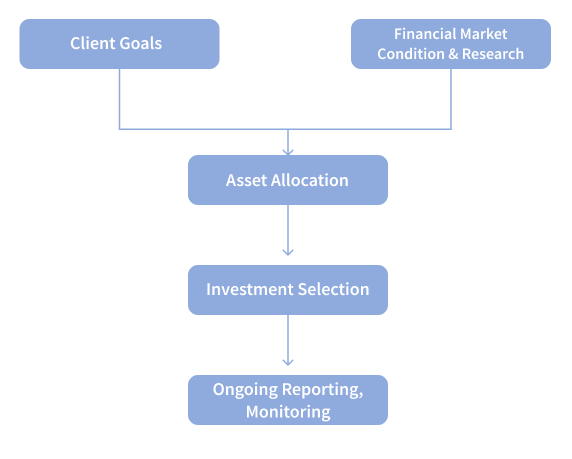

Investment Process

At Fidelis, we use a variety of tools to tailor our investment process to our clients’ objectives, risk tolerance, time horizon, tax situation and investment experience.

“Successful investing is about managing risk, not avoiding it.”

– Benjamin Graham

Portfolio Process

After understanding our clients’ goals, we undergo an investment review process focusing on research, optimal portfolio selection, and ongoing monitoring.

Asset Allocation

We employ a variety of asset classes to help balance risk.

- Real Estate

- Alternative Investments - Example: Hedge Funds, Precious Metals, etc

- Cash & Cash Alternatives

- U.S. Equity

- Emerging Market Equity

- Fixed Income

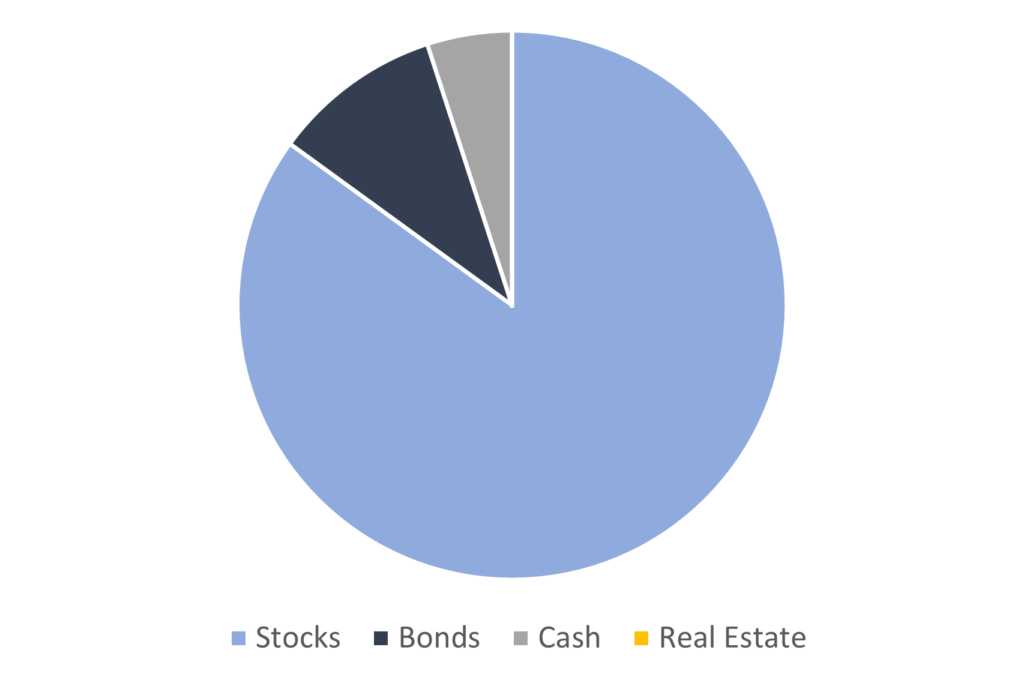

HYPOTHETICAL GROWTH-FOCUSED PORTFOLIO

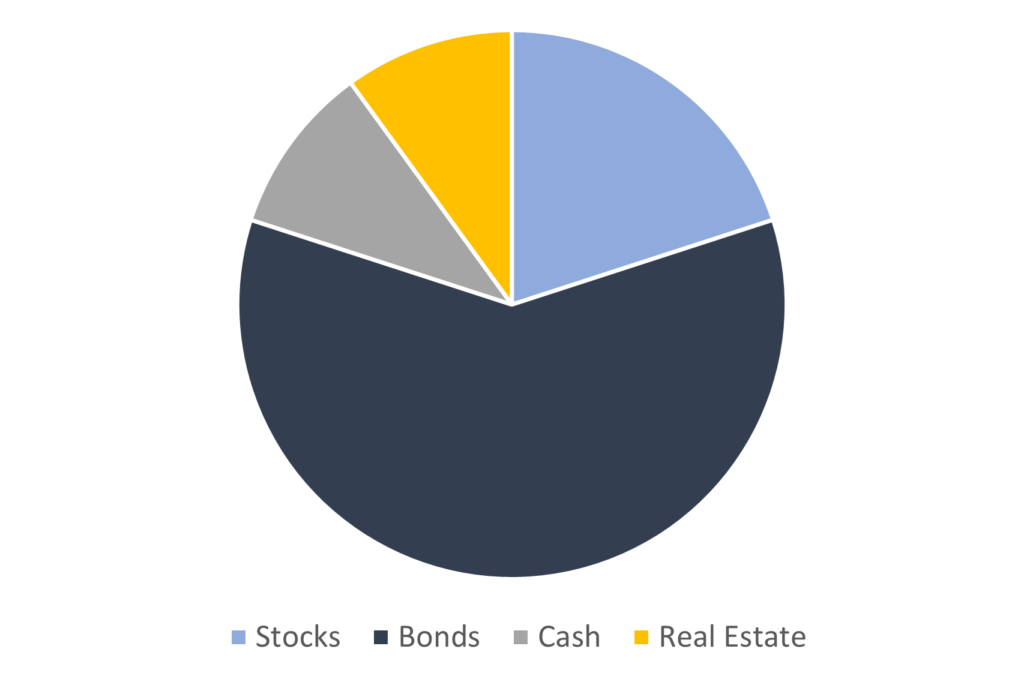

HYPOTHETICAL INCOME-FOCUSED PORTFOLIO

Investment Selection

A top-down investment approach, driven by research.